About one in three people is eligible to file a tax refund claim. That equals tons of individuals, and you might be one of them. A lot of money is left unclaimed at the tax office, frequently because of ignorance or a lack of time to handle the procedure. Understanding your tax situation can be quite beneficial, perhaps saving you money and taxes down the road. This guide will cover everything you need to know about tax rebate and how to claim it.

First, let us discuss the definition of tax refund or rebate. Then, we can move on to the methods you must use to claim it.

What is a Tax Refund or Rebate?

If you paid too much tax on your personal income or qualify for specific tax reliefs that are refundable, you can claim a tax rebate or refund. This way, you can receive a portion of your money back.

Usually, no mistakes occur in the tax system as it works effectively. However, there are certain situations where errors can happen. In these cases, tax rebates are a necessity.

Therefore, you should stay updated on your finances to comprehend your tax position. This will guarantee that you do not end up paying more than you need to.

Suppose you overpay your tax bill and do not get an automatic rebate. Then, you must follow the process to claim your tax refund.

How to Calculate Your Tax Obligation

Paying too much income tax is one of the most common reasons for a tax rebate.

Once you cross the threshold of personal tax allowance, which is £12,570, you become liable to pay income tax. Income from employment is not the only one that counts as your personal income. Your ‘earned income’ includes interest on investments, pension payments, and income from life annuities.

You may not earn a large amount of basic salary, but you can still qualify for higher rates of tax because of other income sources.

It is the responsibility of your employer to give you the correct tax code. While the responsibility to fill in the tax return accurately lies on you. This is crucial as various sources of personal income qualify and HMRC relies on you and your employer to declare it accurately.

Nevertheless, there is still the possibility of miscalculations. Therefore, you must observe your tax reading. This is especially true for those who switched jobs during the tax year.

What Can You Receive a Tax Refund on?

You can receive a tax refund on any taxable income on which you have paid taxes, such as

- Salary from your previous or present employment.

- Annuity income from a life or pension plan.

- Pension benefits.

- PPI or savings interest.

- A tax return using self-assessment.

- Foreign earnings.

- Redundancy payment.

- If you reside overseas, your UK income.

- Costs associated with the job, such as clothing and equipment needed for remote work.

Are You Due a Tax Rebate?

For those who are wondering, am I due a tax rebate? Here is how you can find out.

If you end up overpaying any tax, you qualify for a tax rebate. Eligibility is also possible if you did not claim certain tax refunds. For example, uniform tax refund.

In addition to notifying HMRC of your allowance in advance to amend your tax code for future earnings, you can claim in arrears of up to four years to receive a refund on any taxes you have overpaid.

Your employment status determines if you qualify for certain refunds. However, these types of refunds require you to pursue them yourself.

If you bore the costs of employment-related expenses, then you can qualify for refunds. For example, professional membership refunds and certain travel and accommodation expenses.

For more information, visit the government website.

What is the Purpose of Your Tax Code?

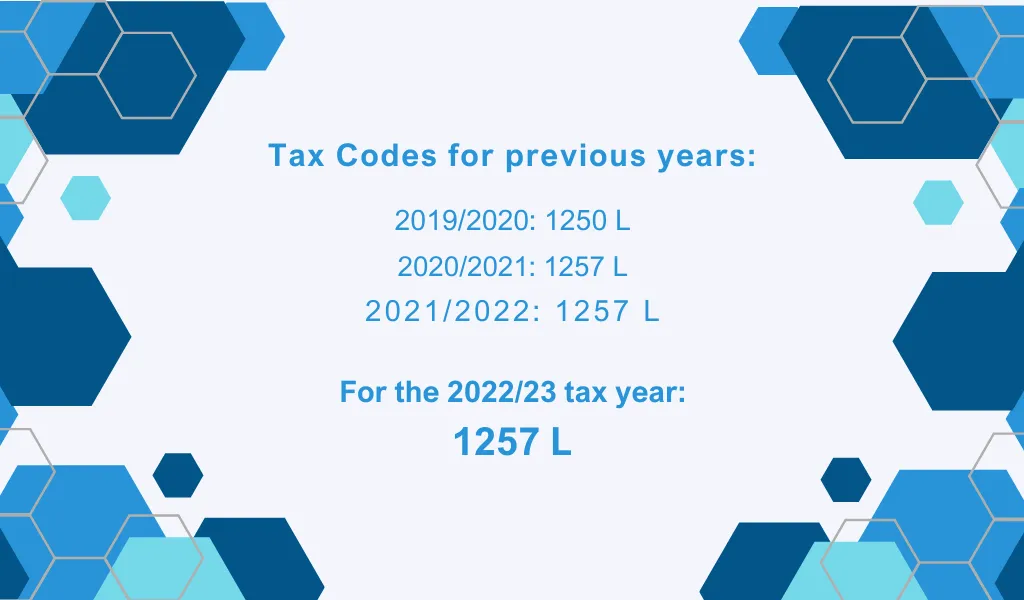

A tax code tells how much income tax needs to be deducted from your earnings. Your employer or other source of income receives this tax code from HMRC.

Please note that the system for tax coding is not perfect. This means that usage of the wrong tax code is possible. As a result, you end up paying either less tax or too much tax.

You can find your tax code online through the HMRC app or on payslips. Also, it is available on your personal tax account. It is necessary to check it regularly, and even more so if your tax circumstances change. HMRC expects that you will inform them regarding any changes that can affect your tax code. You can give them your updated information online.

Can Claiming Tax Rebate Occur Automatically?

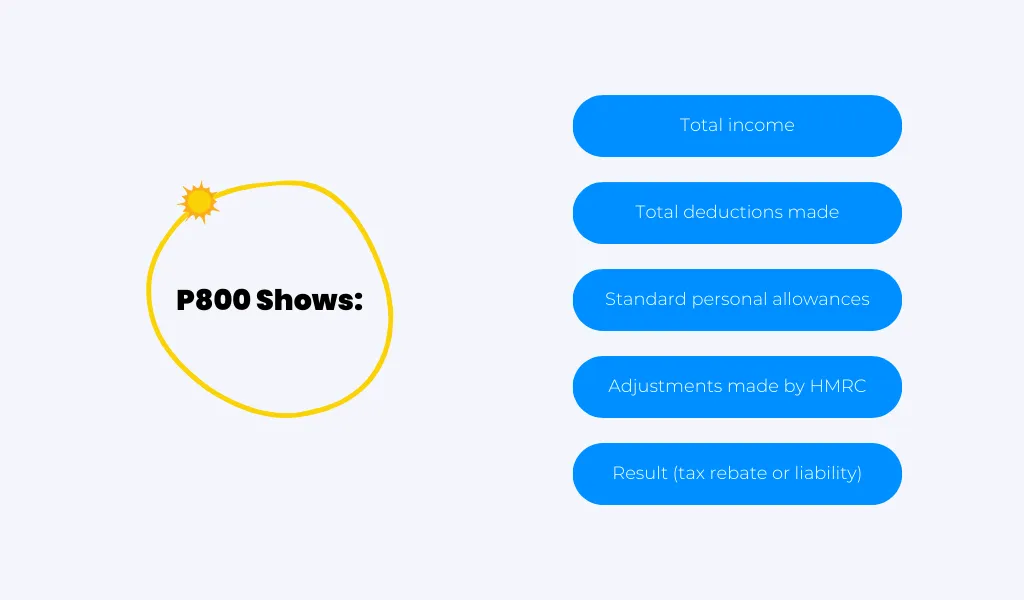

You may not need to make a tax rebate claim if you receive a P800 tax calculation from HMRC. Through a P800, you can find out how much tax they think you need to pay. In case you are due a tax rebate, it is their obligation to arrange it for you.

Whereas if you did not pay sufficient tax, they will tell you how you can settle. For example, they can change your tax code.

However, HMRC does not always know automatically when you have overpaid your tax. Certainly, this is an issue. Suppose you stop working halfway through a tax year. Then it is likely that the PAYE system took too much from your monthly pay.

Furthermore, all types of trouble can arise if you are in the wrong tax code. HMRC may not know about the wrong tax code. As a result, you will not receive a P800. This way you can know the answer to the question: am I due a tax rebate?

Not knowing about your work expenses is one of the major reasons HMRC will not give you a P800. Every year thousands of people lose out on getting their tax back because of this kind of situation.

How Does a Tax Rebate Work?

You can claim your tax rebate through the Government Gateway easily if you receive a P800 that states it.

There are a couple of questions you must answer via the Government Gateway to confirm your eligibility for tax refund. This is a requirement you need to fulfil before you apply.

Then you can gain access to your tax information. Moreover, tracking your refund progress online is possible. You must create a Government Gateway user ID for it.

In case you want to speak to someone, then you can do so through the official helpline which is available on the government website. This includes postal support as well.

Before HMRC can process any tax rebate that it is due, you must complete your tax return if you are self-employed and submit a Self-Assessment.

What should you do if you do not receive a P800? Well, you contact HMRC through their online portal or by calling them on their helpline.

What Information is Necessary for Claiming a Tax Rebate?

You cannot get a tax refund without answering HMRC’s questions. You require certain paperwork to claim a tax rebate, including:

- Documentation of your travels to and from temporary offices or bases.

- Your salary slips for the month.

- A picture ID, like a passport or driver’s license.

- Documentation of residency, such as a power bill.

- Your work-related cost receipts.

- Additional paperwork, such as MOT certifications or HMRC forms.

What to do If You Do Not Have Complete Records for Your Claim

To claim a tax rebate, you do not need a lot of paperwork. Only a few basic details are necessary for you to make the claim. Of course, you require details of the amount you have earned and the amount you have paid in tax. Therefore, you can start with your payslips.

Plenty of useful information is available on a payslip that you can use to claim a tax rebate. This includes complex matters such as sick and maternity pay. Furthermore, they should also mention if your employer has reimbursed your work expenses. This will have a tremendous impact on the amount of refund you can get. Therefore, it is important to know the answer to the question: how does a tax rebate work?

Is There an Easier Method to Claim Tax Back?

For those who do not like keeping invoices and receipts, there exists a simpler alternative. There is no need to keep accurate records if you use HMRC’s ‘flat rate deductions’ systems to claim tax relief on your work expenses. The work you do determines the amount of rebate. However, flat-rate deductions do not exist for every type of job. In case HMRC has not specified an amount for the type of job you do, you may still qualify for a standard deduction.

Certainly, this makes claiming easier as compared to a full tax rebate claim. Unfortunately, this method will not get you back everything that you are owed. It is best to reach out for expert advice in such cases.

How Much Can You Get Back?

Various factors form the basis of calculating your tax refund. This includes your income bracket, expenses you paid for because of your job, and whether you work from home. Expenses such as the cost of equipment, services, or vehicles are part of the calculation.

Your income tax rate and how much you have spent determine certain allowances. For example, cleaning costs and clothing repairs.

Here is an example to elaborate on the amount of tax rebate you can receive:

You spend £70 on cleaning your work uniform per year. Then, you can claim a tax rebate of 20% of this amount.

20% of £70 = £14

When Will You Get It Back?

At the end of every tax year, you receive a P800 that informs you of refunds that you can claim.

Within approximately five working days, you will receive a P800 automatically. However, within fourteen days or so, you can also receive a cheque. Please note that it can take longer than this.

You will receive one cheque only if you are going to get a refund that covers more than one year.

If you make a query regarding your Self-Assessment tax return, the process may take longer.

The nature of your enquiry and your circumstances determine the amount of time it will take to hear back. You can see how long the queues are through the tracker the government provides you.

Surely, the tax system is complex. Nevertheless, you can claim back refunds worth hundreds of pounds with the help of experts. To find out whether you qualify for a tax rebate, you should get in touch with an accountant. Now, you know the answer to the question: how does a tax rebate work?

Why Can You Not Get a Tax Rebate?

Not everyone is eligible to claim a tax rebate. This is not always a bad thing. When you are not due any tax back then that means you did not overpay tax. For instance, perhaps your employer takes care of all your travel expenses relating to work. Anyone who does not travel to temporary workplaces cannot make a mileage claim to HMRC. This is another great example of such a situation. Whereas, if you are self-employed then you must claim rebates for work expenses through your Self-Assessment tax return. Therefore, in certain situations, you are better off without any tax rebate due.

Conclusion

To summarise, it is possible to overpay or underpay your tax bill. In such cases, you can claim tax back from HMRC. Depending on your circumstances, you can reach out to HMRC and make your claim. Furthermore, it is important to make sure your tax code is correct. If not, then you can ask HMRC to change it for you. You can check your eligibility for a tax rebate before you apply. The Government Gateway can help you with the process. If you are a self-employed worker, then you can claim your tax refund through your Self-Assessment tax return. However, for those who receive a P800, it is not necessary to claim a tax rebate. HMRC will take care of it automatically. It is always best to reach out for expert advice regarding your eligibility.