You must pay income tax on your earnings, whether you work for a company or are an investment in real estate. Make sure you are aware of your income tax band before filing your taxes and paying HMRC. You are fortunate to have access to a personal allowance. This implies that you won’t be required to pay taxes on earnings up to the threshold. Besides this, there are other methods for lowering your income tax obligation. This guide will cover everything you need to know about tax savings.

Let us start by talking about what income tax is and how it applies. After that, we can discuss allowances and other advantages.

What is Income Tax and What is its Purpose?

Based on your annual income, you pay the government tax, which is called income tax. You must pay taxes on the profit you make in case you are self-employed. This is inclusive of any products and services you sell or provide online.

The key source of the government is income tax, which HMRC collects for them. Now, what does the government do with income tax? Well, it uses it to fund public services. For example, education, the welfare system, and the NHS. Additionally, it uses the revenue for other investments as well, which are for public use. Road construction, housing, and railways are just a few such examples.

Who Needs to Pay Income Tax?

Moving on to the question, which incomes are taxable? Most types of income are subject to income tax, such as profit from your business, salary from your job, pension, and the rent you receive as a property owner. Furthermore, estates, corporations, and other kinds of entities also owe taxes on the profits they make.

There is no need to stress, as not all your income is taxable. Fortunately, in most cases, you are eligible for at least one type of tax relief or tax-free allowance. The amount of income you can earn before it becomes liable for income tax is called an allowance.

What are the Income Tax Rates for 2024?

The table below shows the current tax rates that apply to your income:

| Income Tax Band | Taxable Income | Tax Rate |

|---|---|---|

| Personal allowance | £0 – £12,570 | 0% |

| Basic rate | £12,571 – £50,270 | 20% |

| Higher rate | £50,271 – £125,140 | 40% |

| Additional rate | Over £125,140 | 45% |

What is Personal Allowance?

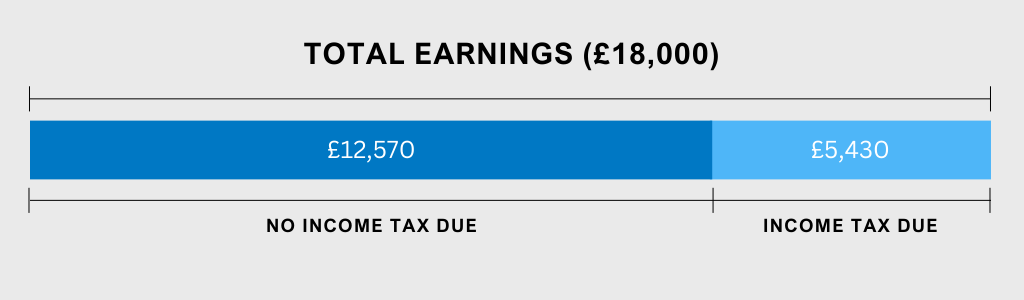

Every UK taxpayer has a personal allowance. This is the amount you can earn before you owe tax on your income. As soon as you start earning more than your personal allowance, you are liable to pay tax. You must do so on the amount you earn which exceeds the personal allowance threshold. It is according to your level of income from self-employment or under PAYE.

For the 2024/25 tax year, the standard personal allowance is the same as the previous year, which is £12,570.

Your personal allowance must remain accurate as it generates your tax code. Also, it helps figure out how much you must pay to HMRC. Thus, you should make the most of your personal allowance:

What is the Blind Person’s Allowance?

Aside from the personal allowance, a blind individual receives an additional allowance. For the tax year 2024/25, it is £3,070, which is more than the previous year, as it was £2,870.

It is crucial to meet certain requirements to qualify for the allowance. You are eligible for this allowance in England and Wales if you register with your local authority as blind. Also, you can register a severely sight-impaired individual. It is necessary to provide a certificate stating the same. If you have a document from your doctor, that can also work.

The rules differ in Scotland and Northern Ireland. If you cannot do work that requires sight and have a certificate that can prove your impairment, you can claim the Blind Person’s Allowance. Again, a document from your document is sufficient as well.

Here is an example to elaborate:

Suppose you are registered as blind with your local authority and are 56 years old.

Your annual salary is £20,000.

Deduct your personal allowance of £12,570.

£20,000 – £12,570 = £7,430

Also, deduct your blind person’s allowance of £3,070.

£7,430 – £3,070 = £4,360

Thus, you owe tax on £4,360 only.

What is Marriage Allowance?

If you are married or in a civil partnership, you can claim the marriage allowance. It is possible to transfer your unused personal allowance to your spouse or civil partner. You can use this method when your income is not sufficient for you to use your personal allowance fully. However, if your spouse or partner is a higher rate or additional rate taxpayer, you can take advantage of it. For the 2024/25 tax year, the maximum amount that you can transfer to your spouse or partner is £1,260. This is the same as the previous year’s allowance.

| Item | 2023-24 | 2024-25 |

|---|---|---|

| Income limit for Married Couple’s Allowance | £34,600 | £37,000 |

| Marriage Allowance | £1,260 | £1,260 |

| Maximum amount of Married Couple’s Allowance | £10,375 | £11,080 |

| Minimum amount of Married Couple’s Allowance | £4,010 | £4,280 |

| Blind Person’s Allowance | £2,870 | £3,070 |

How to Calculate Your Taxable Income for the Current Tax Year

To work out your taxable income for the tax year, you must follow these three stages:

1. Total Your Taxable Income

The first step is to add all your income together. This includes income from any source. For example, freelance work, self-employment, rental income, state benefits, and pensions. Furthermore, you need to deduct your personal allowance. For the 2024/25 tax year, it is £12,570. Please note that you should not factor in any income that you earned from investments and savings. These you will deal with later. Therefore, you must take your total taxable income and deduct your personal allowance from it to arrive at the correct figure.

2. Make Allowable Deductions

There are various forms of tax relief, such as gift tax and pension tax relief, for which you may qualify. You must confirm your eligibility for any tax relief before you proceed further.

Other than tax relief, you can also avail of allowances. You can deduct these allowances, lowering the amount of income you owe tax on. It is possible to claim any one of these allowances:

- Blind person’s allowance

- Marriage allowance

- Trading allowance

- Property allowance

Now, you have made deductions of personal allowance and any additional allowance for which you are eligible.

3. Arrive at Non-Savings Income

Finally, you arrive at the figure which is called your non-savings income. This is the amount you need to pay tax on. The amount of tax you owe depends on which tax band you fall into.

What are the Benefits of Tax Planning?

Through efficient tax planning, you gain plenty of advantages, including:

1. Flexibility While Paying Your Taxes

When you tax plan, you gain a more flexible way to pay your taxes. Whether you are self-employed or run a business, tax planning will take you far.

Not only does it give you full control of your finances, but the timings of your payments as well. Thus, you can remain stress-free regarding needing to pay more taxes than income. Budgeting your finances and achieving sustainability is easier because you have control of all your payment accounts.

2. Get a Wider Perspective

You gain insight into the current financial conditions through tax planning as an individual or a business.

Moreover, to get a vivid idea of potential profits, you can evaluate whether the structure of your business requires modification.

Therefore, as the owner of the company, you can discover new investment opportunities. Also, you can increase profitability by assessing the untapped options.

3. Reduce Litigation

The reason behind tax evasion is usually high taxes. You can fix tax disputes with the government authorities by tax planning.

Since it is the goal of the government to collect maximum taxes, this will help resolve any differences you have with them.

Whereas you are in search of methods to pay the least amount of tax possible. Therefore, you can avoid legal penalties by efficient tax planning.

Methods to Lower the Amount of Tax You Owe

There are various methods through which you can reduce the amount of tax you owe in a tax year, including:

Get the Most Out of Your Pension Contributions

To reduce your taxable income effectively, you can make use of your pension contributions. For the tax year 2024/25, your contribution towards your pension can be up to £60,000 or 100% of your earnings. The lower amount of these two is the one you can contribute. Also, you have the option of the ‘carry forward’ system. Through this, you can make use of any unused annual allowances of the part there years.

Make Use of Tax-Effective Investments

If you are looking for substantial tax benefits, then you can benefit from Enterprise Investment Schemes (EIS) and Venture Capital Trusts (VCTs). Not only do EIS and VCTs provide tax relief on the amount you invest, but they also offer potential exemptions on your capital gains tax.

Claim Your Allowable Expenses

You can qualify for certain tax reliefs if you are a self-employed individual. This means you can make deductions from your taxable income. For example, equipment, travel, and professional subscriptions.

Use Your Dividend Allowance

You can use dividends to increase your income without paying income tax. Those who are business owners or hold dividend-paying investments can do so.

Through this allowance, you can get up to £500 tax-free dividends as of 2024/25. However, you owe a dividend tax if you surpass this threshold. The rate for dividend tax is likely lower than your income tax rate. Hence, using dividends will likely prove beneficial for you.

Make Contributions Towards Your ISA

If you are searching for a tax-efficient way to save, then look no further than Individual Savings Accounts (ISAs). For the tax year 2024/25, you can make contributions of up to £20,000. This is the threshold that is free of any tax on dividends, interest, or capital gains that you earn within the ISA.

Utilise Salary Sacrifice Schemes

Another way to reduce your income tax liability is to benefit from salary sacrifice schemes. You can do so if your employer offers them.

If you are an employee, you need to let go of part of your salary in exchange for other benefits. For example, childcare provided by the employer or higher pension contributions from the employer. You can use salary sacrifice schemes to decrease the amount of tax you owe since your income is lower. Moreover, it is possible to keep your income below specific thresholds.

Before using this scheme, you need to evaluate the value of the benefits you will receive in exchange. Under certain circumstances, it may not be the best option for you.

Remain Up to Date on Tax Law Changes

Every year, there are significant changes to the tax rules and regulations. You must stay updated on these changes as they impact your tax bill. It is ideal to reach out to a tax professional. This way, you can make sure that you are taking maximum advantage of all deductions available to you.

Conclusion

To summarise, this new year is bringing quite a lot of changes, which you must brace yourself for. The amount of income tax you owe in a tax year not only depends on the tax band in which you fall but also the allowances you qualify for. You must know which allowances you can deduct to lower your income tax bill. Make sure that you pay the right amount of tax and do so within the deadline. Otherwise, you will face penalties. Remember, it is best to seek expert advice.