By saving money, you can have peace of mind as it improves your financial security. It also helps you in planning your future. When you place your money into a savings account, you do so with the hopes to grow it tax-efficiently. You may wonder if you must pay tax on the interest you earn from savings. This guide will answer all your questions regarding interest from savings and how to pay tax on it.

First, let us discuss the amount of tax-free interest you can earn. Then, we can move on to the methods you can use to avoid exceeding this threshold.

What is the Personal Savings Allowance (PSA)?

The highest amount of interest that you can earn with no need to pay tax is called personal savings allowance. In April 2016, this allowance was first introduced.

Savings accounts are not the only this applies to. Any interest you earn from other financial products is also subject to it. For example, annuity payments, bonds, and peer-to-peer lending.

As a saver, you can earn a maximum of £1,000 a year in savings income, which is free of tax. Please note that your income tax band determines the amount of allowance you receive. You get your PSA automatically. Therefore, there is no need for you to claim it.

Following are the current thresholds:

| Income tax band | Personal savings allowance |

|---|---|

| Basic rate | £1,000 |

| Higher rate | £500 |

| Additional rate | £0 |

What did people do before its introduction in April 2016? Well, up till that point, they protected their savings income from HMRC through tax-free cash ISAs. Implementing PSA made cash ISAs less attractive to people. It is now possible to earn tax-free money from other types of savings accounts.

Undoubtedly, it is important to learn money management, especially regarding savings.

Does Savings Interest Classify as Income?

Indeed, savings are classed as income. This means you must add it to your income to arrive at your total income figure.

It is possible for your income to fall into the higher tax bracket because of your savings interest. That is because HMRC deem it taxable.

What Savings Interest Does Personal Savings Allowance Cover?

Any interest you earn from your bank accounts, credit union accounts, building societies, government bonds, savings accounts, falls under the coverage of the PSA. Furthermore, it includes interest from trust funds, payment protection insurance (PPI), government or company bonds, and certain life insurance contracts.

Additionally, interest from peer-to-peer lending also falls under this category. However, any dividend income from funds or shares does not count as a savings interest, as it has a separate allowance. Although the PSA does not include dividend distribution, it does cover interest distribution from authorised unit trusts. Also, it covers investment trusts, life annuity payments, and open-ended investment companies.

What is the Starting Rate for Savings in the UK?

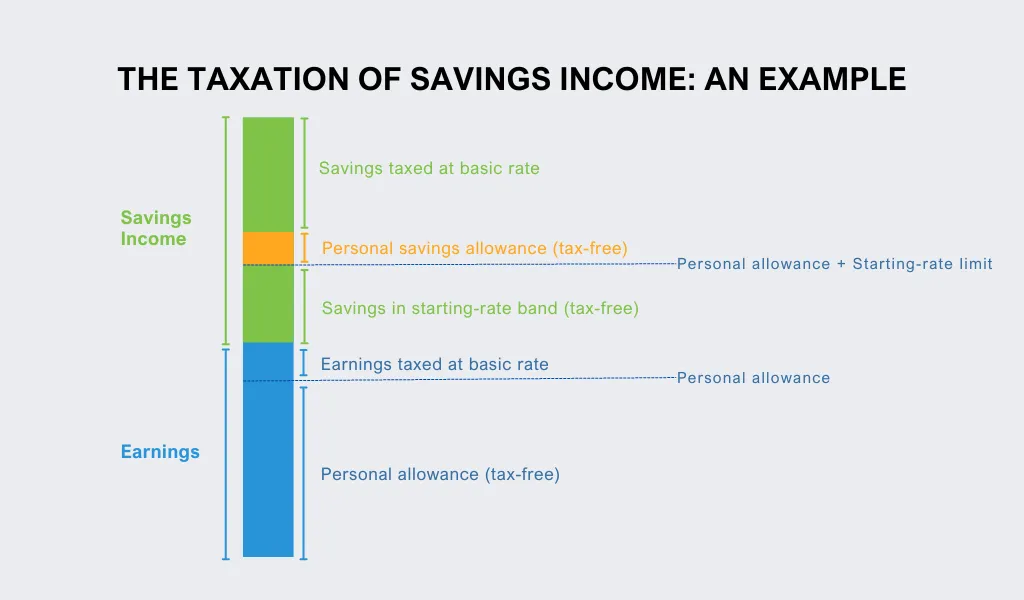

First, let us clarify that the PSA and the starting rate for savings are separate. It allows lower earners to receive tax-free interest from savings.

Now, what is the criterion for the starting rate for savings? To qualify, your other income must be under £17,570. In this case, you will still receive £1000 PSA.

Furthermore, the highest starting rate for savings is £5000. For every £1 you earn from other income exceeding your personal allowance, the rate reduces by £1.

The amount of income you can earn tax-free is your personal allowance. Currently, the basic allowance is £12,570. In this case, for every £1 of income in between £12,570 and £17,570, your starting rate will reduce by £1.

Savings Interest and Self-Assessment

It is mandatory to mention any interest you earned from savings when completing your self-assessment tax return for the year. When HMRC processes your tax return, any tax-free savings that apply are used automatically. They will also calculate whether you are due a savings interest tax rebate.

Suppose your interest income from savings exceeds £10,000 and you do not complete a self-assessment tax return. Then, you need to register for self-assessment as per HMRC rules.

How to Pay Tax on Interest from Savings?

Your income type and completion of tax return determine the method in which you must pay income tax on your savings interest.

Employed under PAYE or Get a Pension:

Through estimation of savings interest income based on the preceding tax year HMRC will change your tax code.

Your pension provider or employer will use the tax code that HMRC generates. As a result, you will pay tax automatically. This is in accordance with the estimated interest rate figures that which HMRC calculated.

Self-Assessment:

HMRC calculates the amount of tax you owe on interest income declared on your tax return when they receive.

Your SA302 tax calculation will show the amount of interest income. Also, it will state the total tax due figure which is from all taxable income.

What Occurs When You Exceed Your Personal Savings Allowance?

Moving on to the question of what happens when you surpass your personal savings allowance? In this case, HMRC collects your due tax through pay-as-you-earn (PAYE). Once this takes places automatically, you can see that your tax code has changed.

By estimating the amount of savings interest you will receive in the tax year, HMRC determines your tax code. It gathers information from building societies and banks to calculate this figure. Also, to work out your allowance, it will check your tax band.

You must report the interest you earned on savings in your tax return if you are a self-employed individual. Thus, you will end up paying any additional money through self-assessment.

To verify if you have surpassed your limit, HMRC receives information regarding savings account from banks and building societies.

Your building society or bank will inform HMRC about the amount of interest you received at the end of the year if you are not self-employed and do not have a pension. Then, HMRC will tell you if you owe tax and how you can pay it.

In case any interest you earn surpasses your allowance, income tax will apply at your marginal rate.

Here are examples to elaborate:

Suppose you are a basic-rate taxpayer. In a year, you earned £1,150 in savings income. On the excess amount of £150, you need to pay tax at a rate of 20%. As a result, your profit will erode by £30.

In this scenario, you are a high-rate taxpayer. The amount of savings income you earn in a year is £650. Then, you owe tax at a rate of 40% on the excess amount of £150. Thus, your profit erodes by £60.

Does HMRC Examine Your Bank Accounts?

Now, the question arises whether HMRC can check your savings account to find out whether you are breaching the PSA.

In real time, HMRC is not necessarily viewing all the money in your accounts. However, it has the authority to request any information it requires from banks and building societies regarding taxpayers. The purpose is to make sure that people pay the correct amount of tax.

Ways to Avoid Exceeding Your Personal Savings Allowance

Fortunately, there are a few ways through which you can avoid surpassing your PSA, including:

1. Making Use of a Cash ISA

One method to avoid exceeding your personal allowance is to use a cash ISA. You can protect a portion of your money from the taxman.

When you earn savings interest in a cash ISA, it does not affect your personal savings allowance. An ISA allows you to save up to £20,000 annually.

2. Timing Your Interest Payments

Let us look at another way to avoid going over your personal allowance. Instead of using a savings account where interest comes in annually, choose one that is monthly. By doing so, spreading your savings income over two years is possible. Which is a better option than receiving one sizeable portion of interest together, as this can exceed your threshold for the tax year. Also, you have the benefit of personal savings allowance for both years.

Alternatively, you can time it in a way that you receive an annual interest payment in the following tax year. You can open a second account through which you get the interest in the next tax year simultaneously.

What About Savings Allowance for Joint Accounts?

When it comes to sharing a bank account with your partner, you receive interest which is split between you equally.

This way you can benefit from both of your personal savings allowances.

To clarify, here is an example:

Suppose both you and your partner are higher-rate taxpayers. Each of you has a £500 savings allowance.

With a £20,000 balance and a 4% interest rate, your joint savings account generates a total of £800.

Then, this amount is split between you and your partner. You each receive £400 as interest, which does not exceed your allowance.

You can contact HMRC’s savings helpline if you have any concerns regarding how the amount is split. For more information, you can visit their website.

Savings Interest Tax Rebate

Under the following circumstances, a savings interest tax rebate can arise:

- Your earnings were not enough to pay tax.

- One or both personal savings allowance or starting rate of tax on savings cover your interest income.

Saving Interest Tax Rebate through PAYE

It is possible to backdate a claim for the last four tax years. Therefore, you may make a savings interest rebate claim for several tax years simultaneously.

You must complete an R40 to make a claim for savings interest tax rebate. If you do not live in the UK, you need to complete an R43.

Moreover, there is no need for you to wait until the end of the tax year to send your form. With many other tax rebate claims, this is not the case. You can submit R40 by post or online through the government website.

Savings Interest Tax Rebate through Self-Assessment

You do not require an R40 form when you complete your self-assessment tax return. This is because you will get your due refund once HMRC administers your tax return.

Make sure to include your savings interest figure on your tax return. If there is any deduction of tax from your savings income, mention it as well.

Any eligible tax-free savings allowances become inclusive of your tax computation for that tax year through the self-assessment system automatically.

Do You Still Require an ISA?

Typically, taking full advantage of your annual ISA allowance is a great idea. You can exceed your annual PSA and owe tax if interest rates rise in the future. The same goes for having to save more money later.

You gain more flexibility by placing money into an ISA. The reason for this is that you can earn tax-free interest without it counting towards your PSA.

Furthermore, you can benefit from keeping funds in ISAs that grow over time. Any interest you earn from them will remain tax-free.

As additional-rate taxpayers are not eligible for PSA, they can always use an ISA to earn tax-free interest on savings.

Conclusion

To summarise, the personal savings allowance is a tax-free sum that covers the interest you earn from your personal savings. Your income tax band determines the amount you will receive. Basic-rate taxpayers receive the most, while additional rate taxpayers do not receive any allowance. It is important to understand how to avoid exceeding your personal savings allowance. For those who are not eligible for PSA, ISA is an alternative as it provides tax-free interest on your savings.