Tax credits and a few other social security payments are gradually being replaced with Universal Credit (UC). The UK now offers Universal Credit, and HMRC has said that it is no longer feasible for someone to file a new tax credit claim. Universal Credit is going to cover a lot of benefits for those who need it. However, you must meet the criteria for it. It is crucial to understand how Universal Credit works and if it will benefit you more than tax credits. This detailed guide will help you get a clearer picture of how to claim Universal Credit and how it affects your tax credits.

First, let us discuss the definition of Universal Credit. Then, we can move on to its monthly rates for the year 2024/25.

What is Universal Credit?

The UK government supports people who require additional money by giving them a benefit payment called Universal Credit. Anyone who has a low income can claim it, whether they are working part-time, full-time, or are unemployed. Therefore, they are greatly beneficial to anyone who is struggling.

To replace benefits and credits, the government introduced Universal Credit. This includes replacing the child tax credit and the working tax credit as well. Universal Credit is replacing plenty of benefits, including:

- Income Support.

- Working Tax Credit.

- Housing Benefit.

- Income-based Jobseeker’s Allowance (JSA).

- Income-related Employment and Support Allowance (ESA).

If you were already claiming these benefits, then the DWP may have notified you. This notification will let you know what is going to happen next.

In case you did not hear from the DWP, then you do not need to do anything. However, that is not the case if there is any change in your circumstance that the DWP must know about.

There is only one benefit that Universal Credit is not replacing. This is the Severe Disability Premium. For those who already get this benefit, it is not possible to get the Universal Credit.

What are the Universal Credit Rates for 2024/2025?

According to the Autumn Statement, the government stated that DWP benefits are going to increase further by 6.7% from April 2024. This includes Universal Credit.

From April 2024, this 6.7% increase will raise the monthly Universal Credit rates to the following amounts:

| Your Circumstances | Monthly Rates (2024/25) |

|---|---|

| If you are under 25 and single. | From £292.11 to £311.68 |

| If you are under 25 and in a couple. | From £578.82 to £617.60 |

| If you are 25 or over and single. | From £368.74 to £393.45 |

| If you are 25 or over and in a couple. | From £458.51 to £489.23 |

When Do You Need to Move to Universal Credit?

You may need to make a new claim for Universal Credit if changes in your circumstances affect your life. These include a change in your:

- Your employment situation, including whether you’ve taken on a new role or adjusted your hours.

- Changes in the family, including a partner moving in or out, a new baby, or a child starting school.

- Relocating to a new local authority area or changing homes.

Additionally, changes may also occur because you stop or start:

- Taking up the role of a caregiver.

- Making a disability claim.

What Happens to My Tax Credits if I Move to Universal Credit?

If you are currently receiving tax credits, these payments will stop once you claim Universal Credit.

Whereas, you get payment for two extra weeks after making your claim if you get Income support, Housing Benefit, or income-related Employment and Support Allowance. While you wait for your Universal Credit payment, this will help you manage your household.

Please note that when you move from legacy benefits to Universal Credit, it is possible to receive less money. Therefore, you must check before how this will affect your income. In certain situations, it is better to delay claiming for Universal Credit.

When Must You Move to Universal Credit from Child Tax Credit?

In case a substantial change occurs in your life, you will need to move to Universal Credit from Child Tax Credit.

This can take place if you:

- Have a child.

- Get a job.

- Start living with your partner or they move out.

You can receive less or more money than you are currently getting. Whether that is in the form of a Child Tax Credit or other benefits. The rules for counting savings differ from the rules for tax credits.

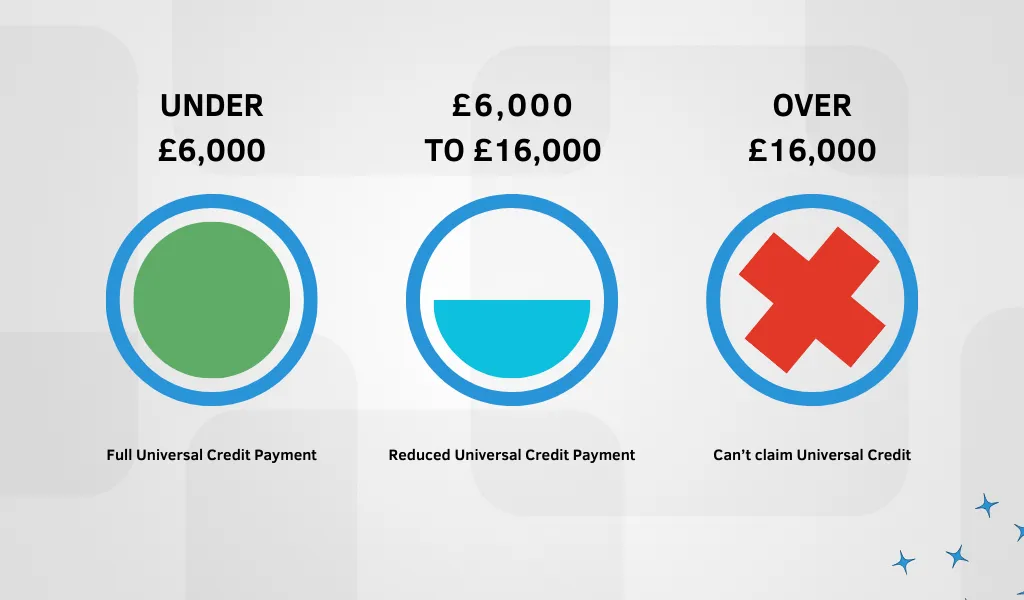

Suppose you have more than £16,000 in savings. Then your circumstances change. In this case, you will not qualify for Universal Credit.

Whereas if you have more than £6,000 in savings, it will affect the amount you receive. If you have doubts regarding how Universal Credit will affect you, it is best to ask for specialist benefits advice.

For those who have one or two children, claiming is possible until they are 19 years old. In some cases, they can claim until they are 20 years old. This applies if the children are in approved education or training full-time, and not at university.

You can claim for all your children if they were born on or after 6 April 2017. In case one or more of your children were born on or after this date, you can only claim for the first two children. The rules differ if you adopted children or had multiple births. Under Universal Credit, you will no longer receive the first child premium.

Once you start receiving Universal Credit payments, including the following elements and additions, they will replace the benefits you are receiving from tax credits currently:

Child Element

This element aids with the expenses of raising your child.

Disabled Child Addition

With this addition, you get help with the extra costs of raising a disabled child. The needs of your child determine whether you will get a lower or higher rate of payment.

Childcare Costs Element

When you work, you can get reimbursed for up to 85% of your registered monthly childcare costs, with a maximum of £951 for one child and £1,630 for two children. Previously, it was £646 and £1,108, respectively. There are distinct guidelines on what you need to do to get your payment if you are on Universal Credit.

| Age | What you must do for your Universal Credit Payment |

|---|---|

| Under 1 | You do not need to work |

| Between 1 and 2 | You must attend interviews with a work coach to plan to move into work. |

| Between 3 and 4 | A maximum of 16 hours of work a week is necessary or looking for work for 16h hours. |

| Between 5 and 12 | Look for work that suits your responsibilities. |

| Age 13 and over | Search for full-time work. |

How Will You Know You Are Moving to Universal Credit?

Moving to Universal Credit will not happen automatically. A Migration Notice letter asking you to claim Universal Credit will come your way. You must make this claim within three months from the date on the letter. If your reason for moving from tax credits to Universal Credit is a Migration Notice, then your savings of more than £16,000 will not affect your eligibility. This applies for 12 assessment periods, which are almost 12 months.

Normal Universal Credit savings rules apply after these 12 assessment periods.

You may need to switch from working tax credit to Universal Credit if your circumstances change. Following are the possible changes in your circumstances:

- Had a child.

- Were receiving WTC and became ill.

- Began working less than 16 hours per week.

- Started renting a property in a new local authority area.

How Much Universal Credit Will You Get?

The amount of Universal Credit you are going to receive may be less than the benefits you are getting currently. Rules for tax credits differ from the rules of counting savings. If your savings exceed £16,000, you cannot claim Universal Credit as you are not eligible. In case your savings are more than £6,000, it can affect the amount you will receive.

If you believe this may affect you, it is best to reach for specialist benefits advice before claiming Universal Credit.

In case the amount you earn increases or decreases, your Universal Credit payment will also adjust monthly. As a result, you can start working more hours or accept short-term employment. Your Universal Credit should increase if you earn less for one month. It should increase enough to cover the shortfall in your earnings. Please note that no limitation exists on the number of hours you must work, unlike working tax credits. You need to budget cautiously in case your working hours do not remain the same month to month.

The DWP must know how much you have earned in the previous month so that they can calculate the amount of Universal Credit you will receive. The responsibility to notify the DWP regarding this lies with you or your employer. This ensures that you do not get too little or too much Universal Credit.

Can You Claim Universal Credit and Tax Credits Together?

The short answer is no, you cannot. The rules state you cannot claim tax credits while claiming Universal Credit simultaneously.

Your tax credit claim will end as soon as you claim Universal Credit. This is true regardless of your eligibility for Universal Credit. Before you decide to claim it, it is best to reach out for expert advice if you are receiving tax credits currently.

Is it Possible to Make a New Claim for Tax Credits?

According to HMRC, you can no longer make a brand-new claim for tax credits. However, there is one exception to this. People with refugee status can still make claims for tax credits. For those who are currently receiving child tax credits and want to claim working tax credits, you can do so. Or even if it is vice versa. Universal Credit will not affect you yet. This is because it is not a brand-new claim for tax credits. To add other elements to your claim, you can reach out to HMRC.

Likewise, if you want to renew your tax credit claim, that is not a brand-new claim either. Furthermore, if your working tax credit ends and you get a payment which is a four-week run-on, you are still entitled to WTC if you start working again. This applies even if during those four weeks you increase your working hours.

Conclusion

To summarise, if someone requires monetary aid, they can avail it through tax credits. The UK government makes extra payments to those with low income or disability. You have the option to claim working tax credits or child tax credits. However, universal credit is replacing these tax credits. Fortunately, there are plenty of advantages to each of them. Nevertheless, you must check if you are eligible to claim these credits. Eligibility for Universal Credit depends on your savings. If your savings exceed a certain amount, you cannot claim it. It is always best to reach out for expert advice to find out if claiming UC is beneficial for you, as it can be less than the benefits you are receiving currently.