When talking about the financial aspects of a business, you often hear the term share capital. It is a major factor in the structuring and financing of business in the UK. As a business owner, you must understand how share capital works and the advantages of it. Furthermore, it is crucial to get familiar with the different types of shares. This guide will cover everything you need to know about share capital and how it works.

First, let us discuss the definition of share capital. Then, we can move on to its benefits and downsides.

What is Share Capital?

Upon incorporation, limited companies need to assign a ‘nominal’ value to each of their shares. It is also called the par value and is representative of the limited liability of the members of the company. In case the company is wound up, then shareholders must pay a certain sum for every share they own. The par value shows this sum.

The total nominal value of all shares that the business issues is called the share capital of a company. Sometimes, you will find that it is also called aggregate nominal capital.

Suppose a company assigns a nominal value of £1.00 to each of its shares. Furthermore, it has 100 shares. In this case, its share capital is a total of £100.

The share capital of a company does not determine the value of the company. Rather, you must consider each share’s current market value. This is typically more than the nominal value of a share. The difference between the market value and the nominal value of a share is called ‘share premium’.

Why do Businesses Use Share Capital?

There are various reasons for businesses using share capital. A major reason is that it gives them a way to raise funds without having to take on debt. Your business can secure capital with no repayment obligations by offering shares to investors. Not only this, but it also does not need to incur interest. For growing companies and startups that do not have access to traditional credit, this is beneficial.

Furthermore, businesses want to use share capital because it provides them with the benefit of spreading their financial risk among investors. Since shareholders share this burden, there is no need to rely on one lender. As a result, your company will have more financial stability. Moreover, flexibility exists because shareholders are more tolerant towards risks and give the business their support.

How Does Share Capital Work?

You now understand the definition of share capital and the reasons businesses it. Let us move on to how it works. Usually, a company issues its shares through an initial public offering (IPO). Alternatively, it offers shares privately to investors. These investors are a select group. This results in the formation of company shareholders.

Now, how does a company offer shares to the public during an IPO? Well, it does so through a stock exchange. For example, the London Stock Exchange. In the case of a private offering, companies offer their shares to venture capitalists, institutional investors, or angel investors.

After the issuance of shares, it is possible to buy and sell them on the stock market. This way investors can trade their ownership stakes. Various factors including the market conditions, financial performance of the company, and industry trends can cause the price of shares to fluctuate.

What are the Different Types of Shares?

According to the characteristics and rights of the shares, share capital is classified into different types.

The following are the common types of shares:

Ordinary Shares

The most common type of shares that a company issues are ordinary shares. Shareholders get voting rights through these shares. Furthermore, they entitle them to a part of the profit of the company through dividends.

Preference Shares

With preference shares, shareholders get certain preferences as compared to ordinary shareholders. This is in terms of receiving dividends. They also gain preference in case the company liquidates, regarding recovering their investments. Yet, shareholders do not get voting rights with this type of share.

Redeemable Shares

Shares that have a fixed redemption date or are redeemable at the discretion of the company are called redeemable shares. With these shares, companies can purchase these shares back from shareholders. They must do so at a predetermined price.

Debenture Shares

These do not live up to their name as they are a type of debt security and not shares. Nevertheless, you must comprehend them in the framework of company finance and share capital. To borrow money from investors, a company needs to issue debentures. Denture holders differ from shareholders as they do not have ownership rights in the company. Rather, the company owes a debt to them, and they are creditors. Regardless of the profits of the company, debentures pay a fixed rate of interest to debenture holders. Therefore, for those who are looking for steady returns, this is an attractive investment.

A company pays debenture holders before it pays any capital to shareholders when it liquidates. Hence, it is less risky in comparison to owning shares. Nevertheless, there are no voting rights or any potential of entitlement to a portion of the company’s profits beyond the fixed interest. As a result, debentures do not provide you with the same potential for high returns as ordinary shares.

What are the Advantages of Share Capital?

There are plenty of benefits for businesses when using share capital, including:

Raise Funds for Business Operations

The issuance of shares helps your business raise capital for its operations. They can use it to fund development and research or invest in growth opportunities. Companies that want to launch new products or services can benefit from this. Or if they are looking to expand. Please note that to manage these financial transactions you need expert knowledge and accurate bookkeeping. To help keep track of your finances efficiently you should get professional accounting services.

Generate Capital Rapidly

As compared to traditional borrowing methods, issuing shares is a quicker way to raise capital for your business. Bank loans and bonds are the typical borrowing methods. Moreover, your company can then tap into the capital market. Investors are more willing to invest in your growth if you do so.

Investors Get a Stake in the Business

Individuals become part-owners of a company by buying its shares. This means they can have a portion of the company’s profit in the form of dividends. As the value of the company continues to appreciate, shareholders can see their investment grow. Furthermore, they can gain the right to vote. As a result, they can have their say in crucial decisions that affect the company’s direction.

What are the Disadvantages of Share Capital?

Unfortunately, share capital does come with its drawbacks. Businesses can suffer from various downsides, such as

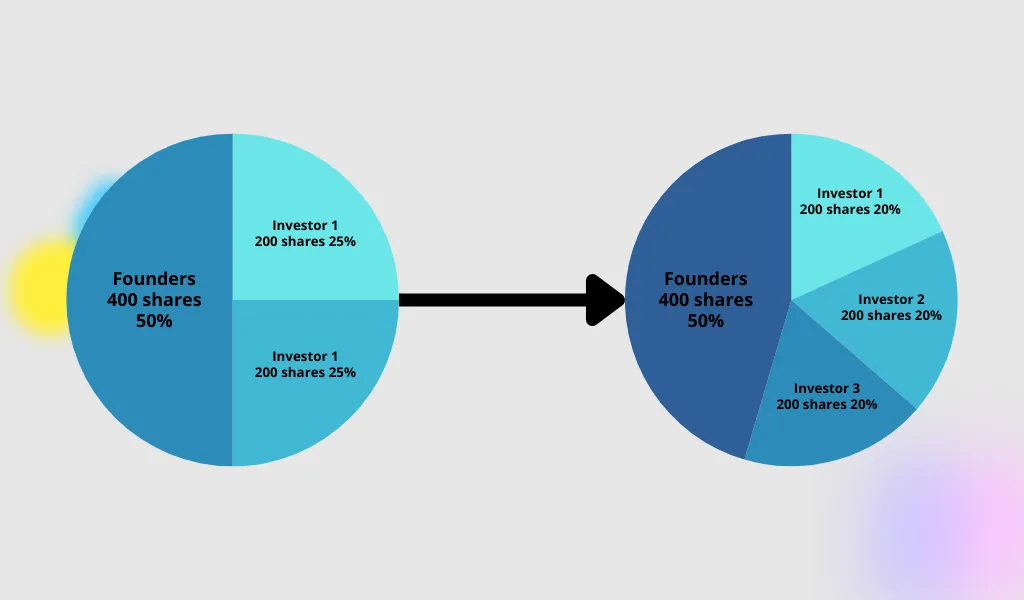

Potential to Dilute Current Shareholders’ Ownership

A major downside of share capital is that it has the potential to dilute the current shareholders’ ownership. The shareholders’ percentage of the company’s ownership decreases as the company issues more shares. This happens because the total ownership ends up spreading across a higher number of shares than before. As a result, shareholders’ control in the company also reduces. Not only this, but the value of their shares can also go down if the company fails to use funds to increase its profits.

Possibly Costly to Raise

Although you get an alternative to debt financing through share capital, it is not an inexpensive method. It is expensive to issue shares, especially if your company does so through an initial public offering (IPO). Substantial costs, such as legal fees, underwriting fees, and other administrative expenses, are involved in this process. Additionally, after issuing shares, your company needs to pay dividends to the shareholders. This will cut into the earnings of your company.

May Cause More Corporate Bureaucracy

An increase in bureaucracy and a slowing down of decision-making can arise because of share capital. It is difficult to make decisions that meet the needs of all parties when there are many shareholders. An important decision can require voting, which can take time for everyone to agree. This will slow down the process of deciding and rob the company of taking opportunities. Please note that if your company goes public, it is subject to extra regulatory scrutiny. This means that it will add to the administrative burden of your company.

| Pros | Cons |

|---|---|

| Raise funds for business operations. | Dilution of shareholders’ ownership. |

| Generate capital rapidly. | Expensive to raise. |

| Investors have a stake in the business. | Increase in corporate bureaucracy |

How Can You Increase Your Company’s Share Capital?

If your company wants to increase its share capital, then it must issue new shares. This is referred to as an ordinary allotment of shares.

For issuing new shares, the existing shareholders need to pass a special resolution. This is so they can consent to the shares being issued. They must also waive their right to pre-emption on the new shares. It is a requirement that a majority of 75% or more of the votes are cast in favour of the resolution. This must take place at a general meeting of shareholders. If not, then a written resolution is necessary.

Then, the company and its directors can finally issue the shares. Nevertheless, this process can vary from company to company.

It is mandatory to file Form SH01 with Companies House within one month of the allotment of shares. This is a notice stating that the procedure has taken place. A statement of capital is part of this form. You must fill it out to show the issued capital of the company after the allotment.

Lastly, within two months you must update the register of members and issue new share certificates.

Conclusion

To summarise, in the financial landscape of businesses, share capital plays a crucial role. Not only does it represent the funds your company raises by issuing shares, but also facilitates raising capital rapidly. Additionally, it can give shareholders ownership rights and diversify risks. Shareholders can gain potential financial returns.

Nevertheless, it does have its downsides, including share price volatility and dilution of shareholders’ ownership. Therefore, your business must consider the financing options available to it and weigh the advantages and disadvantages before going forward.

For those who are involved in the corporate world or are considering investing in businesses, it is necessary to understand share capital. By familiarising yourself with the concept and its consequences, you can make informed decisions to work your way across the financial landscape. Now, you can do so with confidence.