The right business structure is like the cornerstone of a well-built building for real estate development. This cornerstone is where you can build success. Selecting the right business structure for your real estate development project affects much more than just legal requirements. It has a significant influence on your company’s profitability, taxation, liability, and general viability.

Sole Proprietorship

You have full ownership of the business in a sole proprietorship structure. This means absolute control and simplification. It is not all good news, as unlimited limited translates into your personal assets being exposed. In case of legal matters of business debts, your assets are at risk.

Potential legal issues arise as you are liable personally as a sole trader. You are responsible for any debts or losses. On the positive side, all the profits rightfully belong to you. Please note that you need to register with HMRC as self-employed. Furthermore, submitting an annual Self-Assessment tax return is mandatory.

As a self-employed individual, you must pay either Class 2 or 4 National Insurance. The amount of property your business is making determines how much NIC you owe.

Advantages of Sole Proprietorship

Following are the benefits of running a property business with this type of structure:

Straightforwardness

It is a straightforward process to set up a sole proprietorship business. In comparison with a limited company, there are less legal formalities to deal with.

Direct Control

Business decisions are under your direct control as a sole proprietor. There is no need for shareholder consensus.

Less Expensive

As compared to a limited company, it will cost you less to set up and maintain a sole proprietorship.

Flexibility in Tax

Since tax applies to profits as personal income, you can benefit from them as someone who is in the lower tax bracket.

Disadvantages of Sole Proprietorship

Following are some drawbacks of running a property business with this type of structure:

Unlimited Liability

For the debts and liabilities of the business, you have unlimited personal liability as a sole proprietor. This means your personal assets are at risk.

Limitations in Access to Capital

Unlike limited companies, there is limited access to funding sources in a sole proprietorship.

Restricted Potential for Growth

In sole proprietorship, there is a limitation in the potential for growth because of the availability of resources and expertise.

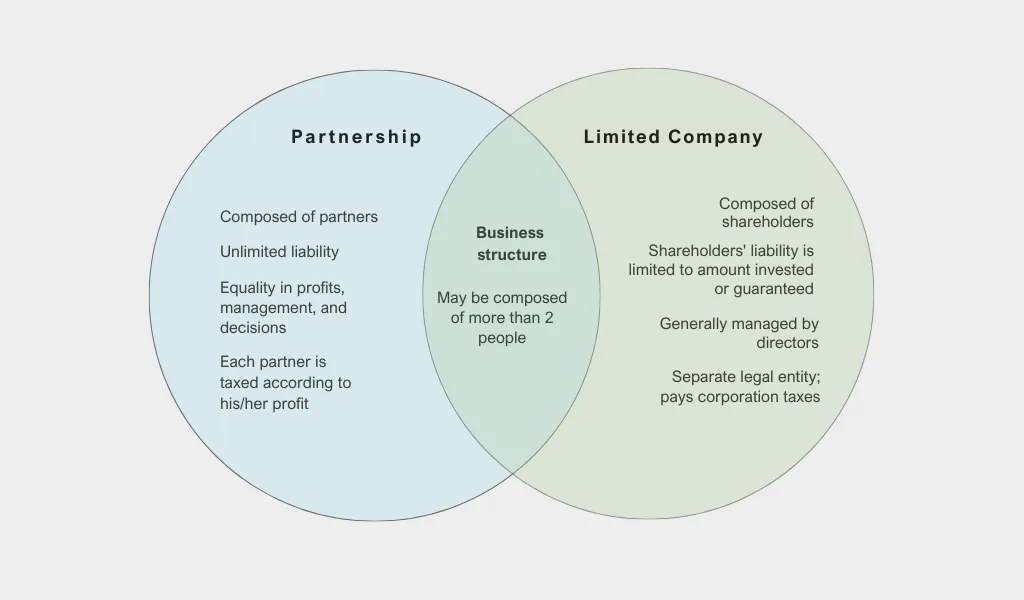

Partnership

An arrangement where at least two people join intending to make a profit from the property business is called a partnership. There exists an agreement between them. They must share the risk, skill, and capital. The partnership agreement mentions this as well.

The process of setting up a partnership is simple, just like a sole proprietorship. This type of structure ensures transparency, as each partner knows where they stand in this business development.

Since it does not involve too many parties, there is confidentiality in a partnership. As compared to limited companies, the regulatory landscape is not as rigorous.

However, there are certain drawbacks. For example, the partners have unlimited liabilities. This means a substantial amount of risk that they must face. Moreover, since it is not a legal entity, it is difficult to raise extra capital for setting up a partnership.

In case any partner decides to leave, it can lead to the dissolution of the partnership. To keep the project going, they will need to form a new partnership.

Advantages of Partnership

This type of property business structure comes with certain benefits, including:

Distributed Risk

There is distribution of risk amongst the partners as they contribute capital. Also, the carry their share of the responsibilities. If there is uncertainty in business environment, this provides a sense of security to them.

Combining Resources

Through this structure you can pool resources, networks, and diverse skills. Therefore, it is possible to increase the capabilities of the partnership.

Non-Complex Set Up

In comparison to a limited company, there are less formalities and legal paperwork while setting up a partnership. With the help of this straightforward process, you can speed up the launch of your business.

Disadvantages of Partnership

Certain drawbacks exist with this type of business structure, such as:

Unlimited Liability

For the debts of the business, partners have unlimited personal liability. As a result, their personal assets are at risk.

Restrictions in Growth Potential

Since there is no corporate structure, it is difficult to attract investment for partnerships.

Management Difficulties

Disagreements between partners can cause hindrance in decision making. Which will affect the smooth operation of the business.

Limited Company

As compared to sole proprietorship and partnership, a limited company provides you with more legal protection. The possibility of substantial financial losses is high in this business structure, therefore legal protection and limited liability are crucial.

All profits made by the company are subject to corporation tax at the rate of 25% within the company. As compared to the highest marginal rate for an individual, which is 45%, this is lower.

Distribution or retention of net earnings after tax takes place for future growth. A limited company has flexibility. This is because it can give dividends or salaries to the individual shareholders of the company. Then, income tax applies to the salary or dividend.

Advantages of Limited Company

Forming a limited company for your property business comes with the following benefits:

Limited Liability

The major advantage of a limited company is that it provides you with limited liability protection. Typically, the responsibility for the debts and obligations of the company does not fall on the shareholders.

Ease of Access to Funding

Funding sources, such as venture capital, bank loans, and equity investment, are more easily accessible to limited companies.

Protection of Assets

Since the assets and liabilities of the company are separate from you, this increases the protection of your personal assets.

Reliability

By running a limited company, you increase the credibility of your business in the eyes of the investors, partners, and clients. Not only that, but it enhances the reputation of your business as well.

Tax Efficiency

As the owner of a limited company, you have more options with tax planning. This includes the ability to take advantage of corporate tax rates and deductions.

Disadvantages of Limited Company

When you own a limited company, you face the following drawbacks:

Complexity

More administrative work is required for limited companies. Not only do you need to register formally and report regularly, but you also must comply with company law.

More Expensive

You deal with higher costs when you set up and run a limited company. This includes registration and professional fees for accounting and legal services.

Less Control

Since it is obligatory to involve shareholders in decision-making, there is a probability of more complex governance.

Joint Venture

When two or more parties join in a common arrangement to begin property development, it is called a joint venture. In this type of property business structure, you and the other parties share the costs and profits of the project.

Every individual contributes different resources to the project. For example, land or capital.

A vital document that outlines the allocation of expenses, costs, and risks is called the joint venture agreement.

Furthermore, each party’s roles and responsibilities are in this agreement. If the property cannot sell, there is a plan of action in place.

If you own properties or land but do not have the required capital for development, then this structure is beneficial. Through a joint venture, it is possible to spread risk effectively. Moreover, you can form a legal partnership with the right company or individuals.

In property development, a co-developer agreement exists. This agreement states the terms and conditions. It also mentions each co-developer’s responsibilities in the business.

Advantages of Joint Venture

When you form a joint venture, you gain a lot of benefits, including:

Limited Timeframe

There is a defined timeframe in joint ventures. Since they are of a temporary nature, businesses are not together forever. Also, there are exit clauses, which make dissolution easy in case a joint venture does not work out.

Larger Scale and Diversification

As compared to working individually, each partner can operate at a greater scale through a joint venture. This could entail having access to a wider market, providing a wider range of goods and services, or having more efficient supply chains opens in new window. It cuts expenses and time to market by enabling a company to enter a new market swiftly and without having to start from scratch with new goods and services.

Shared Risk

Each company taking part in the joint venture contributes to some of the risk, and everyone is working toward the same objective. This can lessen the risk that a single company would incur by going it alone and ensure that invested parties split the sunk expenses in the event of a failure.

Disadvantages of Joint Venture

A joint venture comes with its own drawbacks, including:

Poor Decision Making

Any joint venture requires the crucial aspect of trust. It is difficult for both parties to sign off decisions if there is an absence of trust. Failure can result from making poor decisions and second-guessing the opposite side.

Lack of Privacy

Inevitably, a joint venture will include some information exchange, which may result in you losing ownership of your intellectual property. A data sharing agreement and non-disclosure agreement should be in place from the beginning to guarantee that trade secrets and other sensitive corporate information remain private and that any data problems are appropriately recorded and managed.

Unequal Dedication

Preferably, all-for-one and one-for-all is how a joint venture ought to operate. Unfortunately, one partner’s lack of dedication could result in an uneven joint venture.

Finding the Right Business Structure According to Your Needs

Selecting a property development business structure that fits your objectives, financial situation, and level of risk tolerance is essential to beating the competition. Thus, you should make informed decisions to choose the right business structure for property investment: https://www.youtube.com/watch?v=1oKGsJ3sz1U&t=49s

You should base your decision on a thorough analysis of the needs of your real estate development project.

Reduction in Risk

For personal asset protection and liability reduction, a limited company structure is typically the best option.

A limited company structure is often preferred to safeguard your personal assets and minimise personal liability. Additionally, Special Purpose Vehicles for each project can reduce the risk for group company and other SPV’s inside the group.

Capital Requirements

Furthermore, you must examine the magnitude of your property development projects. You require low funding for a light development project. For example, refurbishment. While heavy renovation requires financing and arrangements over a long term. Any group-up development needs the same level of finance.

Tax Advantages

You must assess your financial goals and tax obligations. By forming a limited company, you gain tax advantages in specific circumstances. However, you need to ensure compliance with company law.

If you need significant amount of funding, then your best options are joint venture with another company or a limited company. Through the issuance of shares, they both can provide you with better access to capital.

Long-Term Plans

It is crucial to consider you long-term plans for expansion. It is possible to gain a professional image and scalability with a limited company.

Conclusion

To summarise, as a property investor you need to choose the right structure for your business. It is crucial to do so as it impacts not only your profitability, but also liability, taxation, and viability. Each business structure comes with its own benefits and drawbacks. Therefore, it is important that you weigh them before deciding. To tailor a business structure to your needs, you must assess risk management, capital requirements, and tax efficiency.