If you are already running a business, then you may have gone through a merger or acquisition. They are transactions that help scale your business. However, if you are not familiar with this terminology, then do not worry. This guide will cover everything about a merger and its various types. It will help answer all your questions. Starting from what is a merger in business? Then, moving on to more complex topics, such as what the process of a merger is. We will also go through the factors to consider before forming a merger with another business.

First, let’s discuss the definition of a merger. Then, we can differentiate between an acquisition and a merger.

What is a Merger in Business?

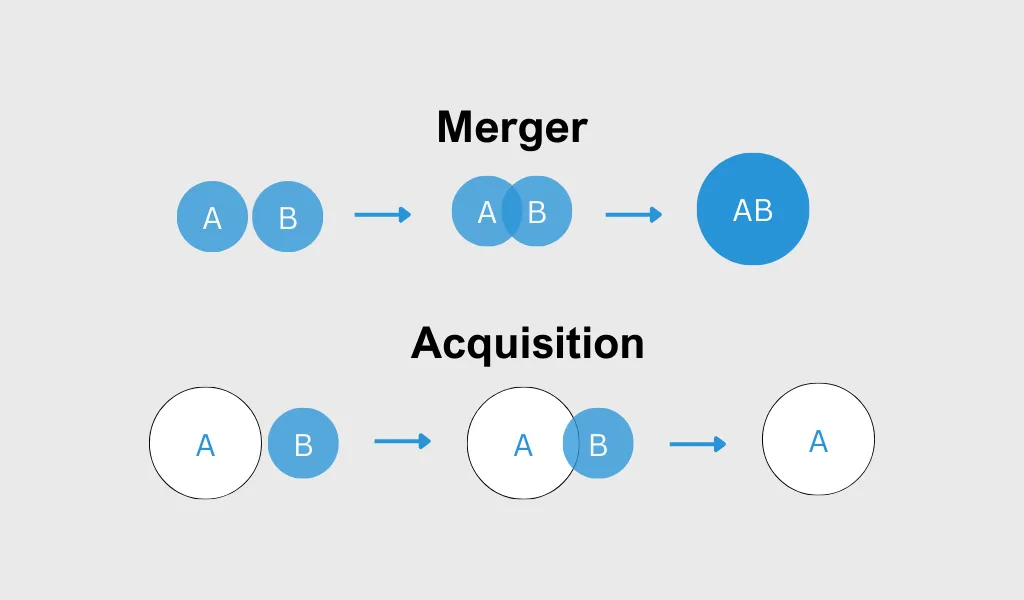

When does a merger take place? Well, a merger occurs when two independent companies decide to join to form a single business entity. Often, this is called a newco. Then, there is a transference of assets, liabilities, and staff to newco. Once this happens, the previous business entities no longer exist as they are dissolved. Furthermore, the newco gets a new name. Usually, it keeps the name of the more renowned business. An example as such is the merger of McDonnell Douglas with Boeing.

What is the Difference Between an Acquisition and a Merger?

An acquisition happens when one company buys the assets or shares of another. The other company remains intact and becomes a subsidiary of the buyer. For example, Google purchasing Android was an acquisition.

The major difference between an acquisition and merger is that mergers are non-hostile affairs of equal partners. They are like joint ventures. After the merger, the business operations and affairs of both companies are steadily unified. Well-known examples include Heinz and Kraft foods, and Exxon and Mobile.

Whereas acquisitions are more hostile. When a potential acquirer approaches the shareholders and board of directors of the target company, they are not welcome. This is called a hostile takeover.

When it comes to private limited companies, one company cannot acquire another unless are parties agree to it. While hostile takeovers are more common with public companies with openly traded shares. An example of one of the largest hostile takeovers is Pfizer, a pharmaceutical giant, buying Warner Lamber.

Since both acquisitions and mergers are complex, M&A is now the new term for when a transaction of any kind takes place between two businesses. Then, what is a merger in business?

The Pros and Cons of Different Types of Mergers

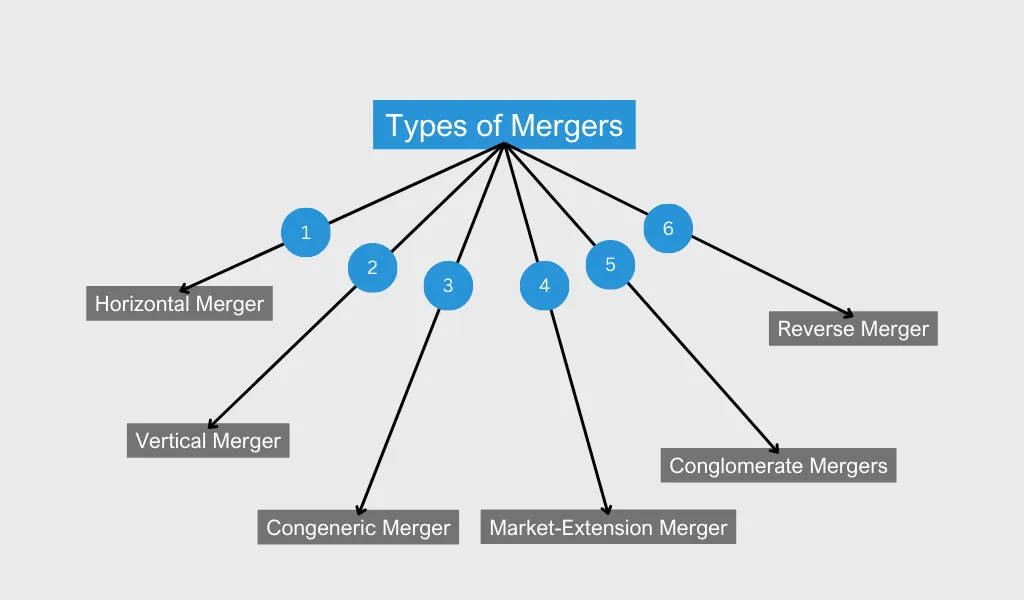

Following are the various types of mergers of businesses:

Horizontal Merger

When two competitors decide to combine, it is called a horizontal merger. Such kind of mergers are beneficial as both companies gain access to each other’s customers. They can also increase their range of products.

The advantages of a horizontal merger include breaking into new markets, expanding market reach, and diversifying product range. Through this merger, you can reduce your competition. Therefore, you get more control over the prices you charge. So, what is a merger in business?

Since mergers of dominant companies can eliminate competition to raise prices, it is better for you to seek professional advice. It is important to do so before agreeing to this kind of merger.

Vertical Merger

When a supplier purchases a customer or vice versa is called a vertical merger. This type of merger involves companies that already purchase or sell to each other or do both.

A vertical merger comes with its own advantages. It increases efficiency and reduces costs. Suppose a flour supplier and a bread making company go through a vertical merger. Then, they can save money since they will pay less for flour.

Furthermore, they will save on procurement expenses because the baker has a single supplier.

Vertical mergers can face regulatory issues just like horizontal mergers. For example, the merger decreases the competition. This happens because the bread maker puts the rest of the flour suppliers out of business. In that case, the merger is not permissible. The size and scale of your business are contributing factors to the application of competition law. Also, so is the size of the affected market.

Please note that the success of vertical mergers is difficult. This is because these businesses are different in nature and management cannot run them side by side without decreasing quality. Then, what is a merger in business?

Congeneric Merger

When two businesses provide different products or services, but have the same customer base, join, they form a congeneric merger. A cable company and a TV manufacturer are such an example.

In such type of merger, the business benefit from the increased access of each other’s customers.

You must make sure that there is compatibility between the two businesses before choosing this option. It is important to ask if this is a good cultural fit. In case it is not, then productivity is likely to drop for a short or medium term.

Market-Extension Merger

Two companies that sell the same products in different markets join to form a market-extension merger. For example, a UK software company merging with a foreign software company. Through this kind of merger, companies gain access to new territories and customers. However, it has its drawbacks. It is difficult to manage separate operations. Moreover, cultural misfit can lead to issues and low productivity. Thus, what is a merger in business?

Product-Extension Merger

When two businesses sell related products in the same market, they join to form a product-extension merger. An example is such is a computer chips manufacturing company and laptop manufacturing company. Even though the products are different, they still fall into the same category.

This type of merger has the advantage of providing more products and services to customers. As a result, you expand your business and earn more profit.

Nevertheless, there are cons to a product-extension merger. Operational difficulties exist and cultural misfit can undermine productivity.

Conglomerate Mergers

When two companies that serve completely different market join, they form a conglomerate merger.

By doing so, each company can expand their services to new market sectors. Therefore, they can benefit from each other’s knowledge and gain a competitive edge over other businesses.

Not to mention that companies that form a conglomerate merger can reduce their exposure to risk. Suppose you sell clothes, but that specific market is facing struggles. Then, you can merge with a market that is thriving. Combining operations leads to a reduction in your market exposure.

You should not overreach when forming a conglomerate merger, especially if you do not have experience in the target’s industry. Additionally, there are more drawbacks, such as low productivity due to cultural differences.

Reverse Merger

If a private company acquires a public company so that it is publicly listed, then it is a reverse merger. To become public, a company must make an initial public offering. Therefore, a quicker way to do so is through the reverse merger. Yet, what is a merger in business?

Through a reverse merger, your business can grow and reach new markets. You can increase your profits and elevate your brand. This is because public companies are considered as more established.

However, there are disadvantages in the form of risks in this type of merger. The company you acquire can have undisclosed liabilities. For example, litigation and unpaid debts.

Furthermore, perhaps you are not ready to go public, especially if you are do not know the rules and regulations that bind public companies. Not to mention that this is a costly route to take to go public. You need money for the purchase and to continue operating.

What is the Difference Between a Merger and a Strategic Alliance?

Sometimes companies form strategic alliances to benefit from specific synergies. For example, access to other customers. However, they do not formally decide to combine businesses. Frequently, this is the case with airlines.

Through this method, the businesses combine forces to accomplish a specific goal or complete a project. They can also improve their image and gain access to resources. There is no need for them to have a formal commitment that a merger involves. Then, what is a merger in business?

Step-by-Step Process of a Merger

Although each business merger is unique, they must all follow a similar process.

The procedure of a merger includes many tasks that are driven by the larger business. However, both companies must partake in them.

Following are the basic steps of forming a merger. Please note that their order can vary:

- Choose the target company and decide to start merger negotiations.

- Assing a legal team and experienced accountants.

- Thoroughly examine the other company.

- Conduct the smaller company’s valuation.

- Get into order the finance you need for the deal.

- Reach agreement on a merger in principle.

- Complete the deal.

- Inform the staff regarding the changes.

- Form an incorporation plan for joining the two businesses.

- Publicly announce the deal.

You should familiarise yourself with the laws and regulations of mergers.

Questions to Ask Yourself Before the Merger

You should ask yourself the following questions before you go down this path:

What is the Reason behind the Merger?

Before you can merge two businesses, it is important for you to know the reasons for doing so. Also, you must know your goals for this merger.

You need to have in-depth discussions with the company’s owners. This is necessary because your visions should align before you can make this happen. Furthermore, you should define success factors and goals as clearly as possible. You have access to a diverse group from both businesses, so use it. So, what is a merger in business?

Objectives vary from person to person. Perhaps you want to grow your market share or scale your business. Or maybe you wish to eliminate your competitor. Clarity of vision is essential when it comes to managing both businesses through this massive change.

Is your Business Financially Ready for the Merger?

Another factor to consider before the merger is to check the financial health of your business. You should hire accountants. They will conduct an internal audit. This will establish if your business can carry out a deal. Moreover, it will check if there is robustness and liquidity.

Additionally, this will help you figure out who much finance you need for the completion of the deal. You can reach out to corporate finance accountants to help you in this situation. Thus, what is a merger in business?

Lastly, you and the other company need to examine each other thoroughly. To avoid any unpleasant surprises, you should test if they strategically fit.

Steps to Take During the Merger

You need to take the following steps during the merger of your business:

Maintain Open Communication

Not only are you merging the operations and processes of your two businesses, but also the cultures. Thus, communication is an important factor. You need to keep it open. If you can, then overdo it.

Rumours of the merger can spread fast, and they will make your staff tense. You need to give as much reassurance as you can and highlight the advantages. Furthermore, you must inform them of any practical information that you require for them to take on board.

By keeping everyone in the loop, you can achieve cooperation and efficiency. Therefore, transparency while communicating is necessary.

Determine Milestones

Unfortunately, mergers do not go as planned. They are never smooth in process. You should learn as you hasten. As you do so, adapt your approach accordingly.

However, you should set targets and milestones for the new company. While holding manages to account, you must also give incentives to employees. This will help in integration. Therefore, what is a merger in business?

Focus on the Details

The success of your merger also depends on minor details. The ones you come across daily. It is your responsibility to do whatever you can to make sure that your staff is safe from the upheaval. This way, they can work seamlessly. You should try to keep them content by focusing on the little things. For example, booking holidays. Then, you will not get discontent in the ranks.

Post-Merger Incorporation

Often, the deal is not the greatest challenge of all. It is what is to happen in the upcoming weeks, months, and sometimes even years.

Make sure that to focus on the bigger picture. This means that you should figure out how the two businesses fit together and remain intact in a merger.

Following are the guidelines for getting through the post-merger phase successfully:

Make Sure to Inform Staff

Finding out about the merger can cause nervousness, doubt, and stress to the staff. If you want to minimise this, you must communicate to them clearly. This will also retain staff. You should provide extra incentives for key employees. So, what is a merger in business?

Create a Consultation System

A system is necessary through which employees can ask questions and provide their feedback. Suppose you hire 50 people and more than 10 pc of them request you to provide such a system. Then, legally, you need to get a consultation system in place.

Conduct a Thorough Assessment to Identify Cultural Differences

Before signing the deal, you need to lay the groundwork for integration. You should discover if there are any differences between the operations of the two businesses. Then, you must come up with a plan to face them.

Detect Issues

You cannot simply hope that things will work out. It is mandatory to detect the problems. Think about what could go wrong. An example as such is that potentially personality clashes can take place between senior staff with the same positions. You need to think ahead and avoid such issues as much as you can. Then, what is a merger in business?

Acknowledge the Natural Leaders

Not every leader in your business is sitting an official position. Co-workers that people look up to and respect are equally important. Any such person can maintain communication and morale. They are valuable in a merger. Make sure to use their positive traits.

Conclusion

To conclude, a business merger takes place when two companies join to form one new business. Together they have more advantages to succeed. However, it is important to know which factors to consider before embarking on this journey. Furthermore, you should know the different types of mergers. There are advantages and disadvantages for each. If you are unsure of which option is right for you, you should seek legal advice.