In the UK, there are two main types of property ownership. One is freehold and the other is leasehold. If you want to purchase a property, then you should know the key differences between the two. It is important to understand the advantages and disadvantages of both types of ownerships. Furthermore, you should know the difference in costs as well. This guide will cover everything you need to know about leasehold vs freehold property.

First, let’s discuss the definition of both. Then, we can move on to their pros and cons.

What is a Leasehold Property?

A leasehold is a type of property ownership where you have the right to live in the house for a specified number of years, but you do not own the land it is built on. The specified period for which you can live in it is stated on the lease. When you purchase a property with a lease, you become a leaseholder.

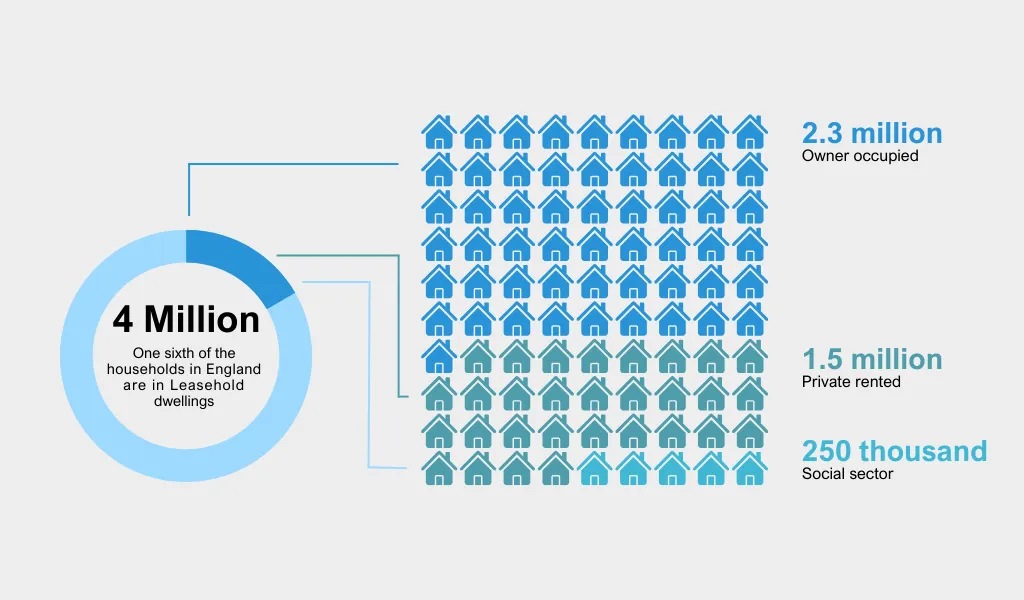

Mostly, flats are owned on a leasehold basis in England, Wales, and Northern Ireland. Whereas, typically, freehold properties are houses. You can only find very few leasehold properties in Scotland.

The landlord owns the land and is called the ‘freeholder’. When the lease ends, they get ownership of the whole property back.

To make specific alterations to the property, the leaseholder needs to get permission from the freeholder.

What is the Length of a Lease?

A newly created lease is anywhere from 99 years or 125 years up to 999 years.

If you have a lease with a 999-year term, then is it as the same as having a freehold? No, it is unfortunately not the same.

Although, there are certain benefits to owning specific properties this way in comparison to owning them under freehold.

Nevertheless, shorter leases cause problems sooner than you think. It is harder to sell a property with a lease that has less than 80 years on it. Furthermore, it is difficult to re-mortgage. Then, what are the advantages of a leasehold vs freehold?

Is it Possible to Extend or Renew Your Lease?

After owning the property for two years, you can extend your lease. However, you can only do it if 80 years remain on the lease.

Please note that you should extend without delay as it will cost you more to extend the shorter it gets.

Typically, extension of a lease is by 90 years. Suppose there are 70 years remaining on the lease. By extending it, the new lease will have 160 years.

How much does it cost to extend the lease? Well, it will cost you 50 pc of the ‘marriage value’ of the property. Marriage value is the additional value the property will get by extending the lease.

This means that you will need to pay approximately 50 pc of the extra resale value that you will get upon selling. That is why you should the difference when it comes to leasehold vs freehold.

Other factors that determine the cost of extending include the worth of the property and improvements you made to it.

Following are the costs you will incur:

- Property appraisal.

- Update fees for the Land Registry.

- Legal expenses.

- Stamp Duty (but only if the extension costs exceed £125,000).

What are the Unique Features of Leasehold?

Typically, leasehold properties are flats. Yet, some houses are leaseholds. This is especially true when you buy them through a shared ownership scheme.

You do own the land the property sits on in case of a leasehold. If you buy a flat, then you are not the owner of the communal areas. This includes the hall, stairs, and the structure of the building. When it comes to leasehold vs freehold, you should know the major difference.

Before 30th June 2022, a leaseholder had to pay fees to the freeholder. This was called ground rent. Thanks to the government legislation coming into force, you no longer need to pay ground rent on new residential leases. This put an end to increase in annual ground rent. A lot of freeholders already changes their ground rents to zero before the legislation was reinforced. For individuals looking to purchase, this made day-to-day costs more affordable.

There are certain restrictions that come with a lease. For example, you require permission to make alterations to the property. Or you cannot keep pets. You can go to court and risk losing your lease if you break any conditions.

Buildings insurance is the responsibility of the freeholder. However, contents insurance is not.

When it comes to certain maintenance costs, the freeholder should consult with you. If you disagree with specific charges, you can challenge them. Therefore, you need to understand the difference regarding leasehold vs freehold.

What is Freehold?

When you purchase a freehold property, you become the owner of the property and the land it is built on. However, if you fail to make your mortgage repayments, your mortgage company can repossess it.

This is a type of total ownership which is called ‘title absolute’. Sometimes, people use the curious term ‘fee simple’ for it.

With a freehold, it is your responsibility to pay for all costs relating to the property. For example, buildings insurance and repairs.

Maintenance charges usually do not exist. However, they can apply if you share any services with your neighbours. Communal gardens are an example as such. Freehold properties are usually houses. Nevertheless, you can still find some flats with freehold that you can share with your neighbours as a management company.

What is a Flying Freehold?

To simplify, a part of a freehold property that overlaps or reaches into a neighbouring property is called a flying freehold. As the owner of the flying freehold, you own the ‘flying’ area. However, you do not own the building or land underneath it.

Following are examples of flying freeholds:

- A balcony that reaches over someone else’s property.

- Part of a property that is above a shared alleyway.

- A property that is a maisonette.

- Cellars or basements that are underneath a neighbouring property.

- Part of a property that extends over a neighbour’s garage.

- A room that is situated below a neighbour’s different room.

Please note that some mortgage lenders may not approve a flying freehold. Therefore, you should ask questions before proceeding with your application. Thus, it is important to know the key differences between leasehold vs freehold.

What is Commonhold?

To overcome the worst aspects of leasehold, the Leasehold Reform Act of 2002 created an alternative of freehold called commonhold.

This type of property is a multi-occupancy building which is divided into numerous freehold units. The ownership of freehold belongs to each individual flat. A Commonhold Association owns and manages the common parts such as hallways and staircases. The freeholders of the flat own the company that is Commonhold Association.

As a result, a superior freeholder does not exist. Instead, joint management of the common and external parts of the property is in the hands of the owners of the flats. As a result, people are safe from the issues of short leases and greedy landlords. However, conflicts can occur between the Commonhold Association’s member, just like any other form of community ownership.

What is the Price Difference of a Leasehold Vs Freehold?

Suppose you decide to buy a freehold property in Southwest London. It is likely to have a higher value than a leasehold property. Nevertheless, if they have long leases, they have the same price ranges as freehold properties.

Many factors determine the range in price. For example, the size of the property and its location. There is not much difference between the price of a freehold property and a leasehold with a long lease. However, there is a drastic difference when it comes to short leasehold properties vs freehold properties. Not only will you own the property for a limited period, but you will also need to pay for a lease extension.

Before you decide to buy the leasehold or freehold for a commercial property[NH1] , you should look at the pros and cons of both.

What are the Advantages and Disadvantages of Leasehold vs Freehold Properties?

Both types of properties come with their own advantages and disadvantages. It is important to know them before you decide.

Pros of a Freehold Property

Following are the benefits of purchasing a freehold property:

Full Ownership of the Property

If you make your mortgage repayments, you get complete ownership of the property and the land it sits on. Thus, you should know the benefits of purchasing a leasehold vs freehold.

There are No Charges

You do not need to pay admin fees or service charges to the landlord.

Flexibility

You have the right to do as you wish. This means you can make home improvements or have pets. Of course, if it is within the permissions of the local council or authority.

There is No Lease

There is no need for you to keep track of when the lease will end or extend it. This is usually expensive.

Cons of Freehold Property

Following are the downsides to purchasing a freehold property:

Expensive

Since you own the property as well as the land, freehold properties are more expensive.

Type of Property

If you are looking for a flat, then freehold is not the right option for you as they are usually houses. Thus, this type of property limits your options.

Maintenance Costs

It is your responsibility to maintain the entire property and to pay for buildings insurance.

Pros of a Leasehold Property

Following are the benefits of purchasing a leasehold property:

Less Expensive

As compared to freehold properties, leasehold properties are less expensive. Although, the reason for this is the risks that come with them.

Less responsibility

You do not have to deal with the maintenance for the building and communal areas. Furthermore, you are not responsible for arranging building insurance. Hence, you must know the drawbacks when of buying a leasehold vs freehold.

Cons of a Leasehold Property

Following are the drawbacks of purchasing a leasehold property:

Limited Ownership of the Property

Since a leaseholder rents property from a freeholder, they do not have ownership of the property or the land it sits on.

Service Charges

You will need to pay service charges in addition to your mortgage. These charges can increase. If you cannot pay them, your property can be repossessed. Certainly, it is important to know the difference when it comes to leasehold vs freehold.

Restrictions

To make changes to the property, you require written permission from the freeholder. Also, you may need to pay additional fees.

High Conveyancing Fees

Usually, conveyances fees are high for leasehold properties.

Selling is More Difficult

You can miss out on profiting from property price growth since it is more challenging to sell a leasehold property with a shorter lease.

Conclusion

To conclude, a property investor, you should know the difference between freehold and leasehold. It is best to look at the advantages and disadvantages of both before you decide to buy either one. As a leaseholder, you can only live in the house for a specified period, and you do not own the land it sits on. Whereas as a freeholder, you have full ownership of the property, which includes the land. Make sure you understand the costs in both situations. Furthermore, the responsibilities vary as well.

FAQs

What is Share of Freehold?

You own the property leasehold along with a share of the freehold for the building and the land it sits on when you purchase a property with a share of freehold. Typically, this applies to flats.

What Happens When Your Lease Expires?

All legal rights in the property revert to the freeholder of the property once the lease expires. At this point, the freehold title and leasehold title are not separate, but rather one interest. Even if you lived in the house for a long time, the property stops belonging to you once the lease ends.

Is it Better to Purchase Share of Freehold or Leasehold?

As compared to just having a leasehold, having a share of freehold in your property has many benefits. Not only does it grant you more control over the building, but also greater ownership. As a result, you get to have a say in the management decisions.