As the director of a company, you can borrow money from one. It is an excellent way to access funds. When it comes to taking out a loan from a company, you should know the rules governing it. There are a lot of complexities that can come your way. However, you can navigate them if you understand how a director’s loan works and its tax implications. This guide will cover everything about how to get a company loan from director and Director’s Loan Account.

First, let’s discuss the definition of a director’s loan. Then, we can move on to the step-by-step process and tax implications.

What is a Director’s Loan?

When a financial transaction that is not a dividend, salary, or expense repayment, takes place between a company and its director, it is called a Director’s Loan. Specific tax legislation governs these loans in the UK. Furthermore, they require record-keeping. When a director borrows money from the company or they lend funds to the company, it is a director’s loan.

Types of Director’s Loans

Following are the two kinds of director’s loans available:

1. When Director Owes Money to the Company

In this type of loan, the director borrows money from their company. Then, they must return the loan within a specific period. Otherwise, there are tax implications.

2. When Director Lends Money to the Company

In this scenario, the director is the one lending money to the company. Thus, they can withdraw it any time they want to. There are no Corporation Tax implications in this case.

What is a Director’s Loan Account (DLA)?

As a director of the company, when you take out a loan, you must maintain a Director’s Loan Account. Within this account are the records of all the transactions that relate to the loan. These include the records of the director withdrawing cash. Also, when they pay with company money for personal expenses. In case your company has more than one director, then you each need your own DLA. Then, how can you get a company loan from director?

What are the Tax Implications of a DLA?

If at the end of the company’s financial year, your DLA is overdrawn, you may end up paying tax. Nevertheless, there is a way to avoid paying tax. Within nine months and one day of the company’s financial year-end, you must repay the entire loan. In case you fail to do so, then additional Corporation Tax can apply on the amount that is outstanding.

What is a ‘Benefit in Kind’?

At any given time if you owe your company an amount more than £10,000, then it is ‘benefit in kind’. In such a situation, both company and person tax liabilities can arise. Furthermore, the company must pay Class 1A National Insurance. This is payable at a specific rate on the full amount.

Who Qualifies for a Director’s Loan?

The eligibility criterion for a director’s loan is that you must hold the position of a director in a company. Moreover, it is a personal loan to the director and is not subject to either company or personal tax. Therefore, it is important to understand who can get a company loan from director.

What are the Reasons for Taking a Director’s Loan?

There are various that directors take out this kind of loan. These include the need to cover unexpected personal expenses. Nevertheless, you must remember that the company still owns this money. Not to mention that HMRC requires due taxes on such loans.

Surveillance by HMRC

It is HMRC’s responsibility to monitor DLAs. This is especially true for DLAs that are overdrawn on the regular. If they decide that this money is a salary instead of a loan, then they can charge Income Tax. They will charge this on the sum along with National Insurance.

What are the Complexities of a Company Loan from Director?

‘Bed and Breakfasting,’ Rules and Consequences

One of the complex aspects of a director’s loan in the UK is the concept of ‘Bed and Breakfasting’. That is why HMRC chose to introduce a measure that counters this. After the director repays a loan of more than £10,000, then they cannot take any more loans over this amount within a month. If such a scenario takes place, then HMRC can judge that the director will not return the money. Therefore, the full amount is subject to tax in this case.

Interest on Loans When Lending Money

When you lend money to your company and charge interest on it, this is a business expense for the company. While for you, it is a personal income. Thus, you need to declare it as an income on your Self-Assessment. It is subject to tax accordingly.

Writing Off Loans

There are certain accounting and tax implications when a company writes off a director’s loan. Suppose the company wants to reclaim the additional Corporation Tax that applies on the loan amount. Then, on the Self-Assessment tax return, it is necessary for the director to mention the written-off loan as dividends. In such a case, the dividend higher rate threshold applies at 33.75%.

Employer’s National Insurance Contributions

As a director, you must also consider the Employer’s National Insurance Contributions (NICs). The company needs to pay Employer’s NICs in case the DLA account is overdrawn. For the 2022/2023 tax year, the rate is 14.53% of any benefit in kind provided. This includes the director’s loan. Whereas the rate is 13.8% for the tax year 2023/2024.

Observation and Legal Proceedings

You, the director of the company, should know if too much money is borrowed. In case the company cannot repay its creditor, it will go into liquidation by force. The liquidator has the right to take legal action against you to collect the debt in this scenario. Thus, you should know how to get a company loan from director.

Approval of Shareholder for a Loan Exceeding £10,000

You need the approval of shareholders in case of loans that exceed £10,000. In case your company is small, then you are also a controlling shareholder. Therefore, this approval is not a legal requirement, but rather a formality. Nevertheless, to maintain compliance, this step is necessary.

Informing HMRC

You must inform the HMRC regarding your director’s loans. This is especially true for those that overdraw regularly. Remember that HMRC closes monitors these loans. They do so through the annual tax returns of the company. They have the right to decide that the money is a salary and not a loan. As a result, you will face additional tax liabilities.

Expert Advice

It is ideal to reach out to a tax advisor or accountant. Undoubtedly, these rules are complex and there are severe consequences in case you do not comply. A tax advisor can give you sound advice to make sure that you are complying with all legal and tax obligations.

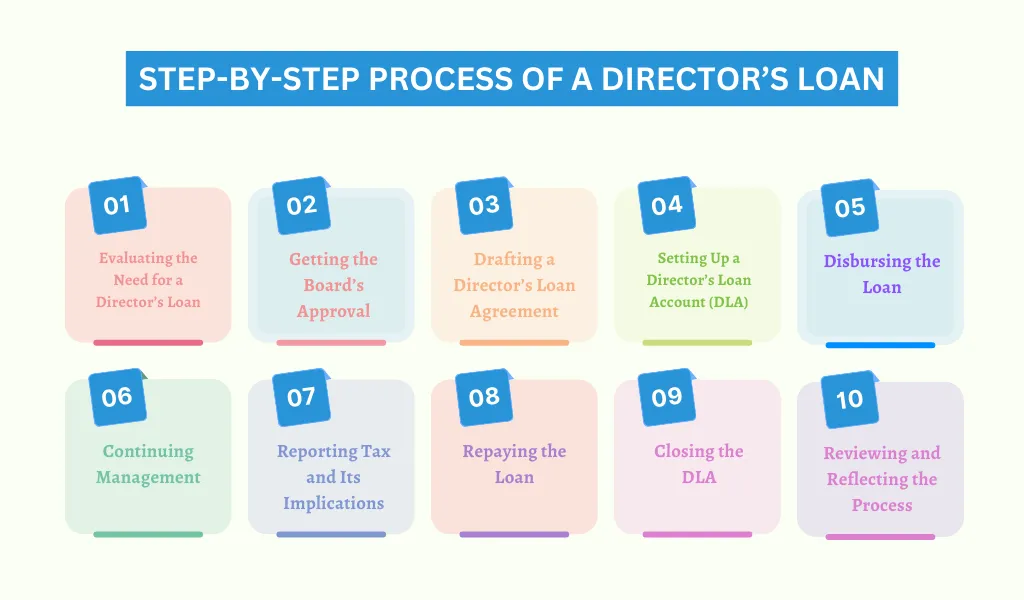

What is the Step-by-Step Process of a Director’s Loan?

For both the company and its director, it is financially convenient to get a director’s loan. However, it is important that you understand how it works. This way you can minimise the risk and maximise the benefits. This step-by-step guide will cover everything from initiation to repayment of the company loan from director.

Following are the essential steps of a director’s loan:

Step 1: Evaluating the Need for a Director’s Loan

First, you must identify your need for the loan. It is important to define the purpose of borrowing money from the company or lending money to it. You should also define the amount that you require. Making an initial evaluation will help you navigate the next steps, and you can make informed decisions.

Step 2: Getting the Board’s Approval

You need to get approval from the board of directors of the company before you can proceed with the loan. Usually, you must hold a formal meeting to discuss and approve the terms of the loan. Furthermore, it is important to record the minutes of the meeting carefully. This is an official document that validates the loan.

Step 3: Drafting a Director’s Loan Agreement

After the approval of the board, it is time to draft a Director’s Loan Agreement. This document states the terms and conditions of the loan. It includes the interest rate, loan amount, and schedule for repayment. To make it legally binding, both parties should sign this agreement after reviewing it. This is an important step in the process of a company loan from director.

Step 4: Setting Up a Director’s Loan Account (DLA)

The next step is to create a Director’s Loan Account. This is necessary as it keeps track of all transactions that relate to the loan. Not only does it record the initial loan amount, but also the interest accrued, repayments, and any other activity relating to it. For both internal auditing and tax compliance, it is necessary to record accurately.

Step 5: Disbursing the Loan

The loan amount is disbursed after signing the agreement and setting up the DLA. If you are borrowing money from the company, then the funds transfer from the company’s account to your personal account. In case you are lending money to the company, then the process is the other way around.

Step 6: Continuing Management

It is essential for you to update the DLA regularly. You must do so to reflect on any more borrowing or repayments. Furthermore, you must calculate and record the interest accurately if there are any in the agreement. Remember to monitor your DLA. This will prevent any problems or discrepancies later.

Step 7: Reporting Tax and Its Implications

You need to comprehend the tax implications that come with a director’s loan. In case you do not repay the loan within nine months and one day after the company’s financial year, then additional Corporation Tax applies. Then, you must complete a CT600A form. A ‘benefit of kind’ is when the loan exceeds £10,000. In this case, to report tax, you require a P11D form.

Step 8: Repaying the Loan

To repay the loan, you must follow the terms stated in the Director’s Loan Agreement. Under the circumstance that you are repaying the company, then the funds go back into the company’s account. Then, the DLA gets an update consequently. However, the process is in reverse if the company is repaying you. Thus, you should understand the complications of the company loan from director.

Step 9: Closing the DLA

The DLA closes after you repay the loan fully and settle all interest and tax obligations. For tax purposes, you should keep all records that relate to the loan. It is important to maintain these records for six years minimum.

Step 10: Reviewing and Reflecting the Process

You should take time to review the management of the process once it is complete. Ask yourself questions such as the following:

- Did you meet all the obligations on time?

- Are there issues that you can prevent in the future?

By doing so, you can gain valuable insights for director’s loans in the future.

If you understand the process of a director’s loan, then you can navigate its complications easily. To successfully handle a director’s loan, you must go through each step carefully. Each step has its own role in the process, from the initial assessment to drafting agreements and the management of repayments. If you want to manage the director’s loan compliantly and effectively, then you should follow this step-by-step guide. It will mutually benefit you and your company. Now, you understand how a company loan from director works.

How to Manage a Director’s Loan Effectively?

Significance of Documentation

You must maintain comprehensive and accurate documentation. This plays a significant role in managing a director’s loan compliantly. Important documentation includes board meeting minutes and loan agreements. It is also important to get timely entries in the DLA. In the case of an audit by HMRC, property documentation provides an accurate record. Therefore, documentation is essential for compliance.

Repaying on Time

It is obligatory to repay the loan within the specific time if you want to avoid possible inspection from HMRC and additional Corporation Tax. If you owe money to the company, then this is important for you. Otherwise, you will end up paying a lot more than you initially had to.

Reviewing Regularly

Additionally, you need to review the status of your DLA regularly. You must do so to make sure that is not overdrawn constantly. Otherwise, it will draw the attention of HMRC. Which you do not want. This can lead to them reclassifying your loan as income and you will end up paying additional taxes. Therefore, this is an important aspect of a company loan from director.

Asking for Professional Help

It is best to consult with financial advisors. There are too many complications and possible tax implications in this scenario. You can also reach out to accountants that have knowledge of UK tax laws. They will navigate you through the complexities of a director’s loan. Therefore, you can make the right choices.

Involving Shareholder

Remember that you need the approval of shareholders when the loan exceeds £10,000. By doing so, you fulfil the legal requirements and make sure there is transparency within your company.

Avoiding ‘Bed and Breakfasting,’

If you want to prevent falling foul of HMRC regulations, then you should remain careful of the ‘Bed and Breakfasting’ rules. Moreover, you need to contact a tax advisor if you decide to repay and re-borrow a substantial amount within a short time. This way, you can comprehend the implications to a full extent. Therefore, there are consequences of a company loan from director.

Effectively Planning for Tax

You can make the most of your director’s loan through effective tax planning. Suppose you are lending money to the company. Then you should charge an interest rate that is reasonable. This is beneficial to you both. For the company, the interest is tax deductible. While for you, it is taxable income.

Conclusion

To conclude, getting a director’s loan is a convenient way for you to access funds. Also, you can inject capital into your company through it. Nevertheless, it is important for you to understand the rules and regulations of this type of loan. There are also tax implications that you should comprehend. If you can do so, then you can navigate the complexities easily and make the most of the director’s loan. Remember, it is always best to reach out for expert advice.

To conclude, as an Airbnb host, you may need to report your income. It is all dependent upon your circumstances and the amount of income you earn per year. If it crosses the specific threshold, then you must report it and pay tax. There is no need to stress, as you can reduce your tax liability with various methods. Furthermore, there are plenty of advantages to running an Airbnb business in the UK. It is ideal to reach out for expert advice before deciding to go down this road.